The nations of Europe have decided to pay their share of the approved 12 billion euro aid to the debt ridden Greece. As per discussions held last year, finance ministers have decided to disburse 8.7 billion Euros out of promised 110 billion euro.

Last week, Greek Prime Minister George Papandreou pushed and passed an austerity plan in the Parliament which drew nationwide protests. The remaining amount will be paid by the International Monetary Fund. That will be the fifth installment of the promised 2010 package.

The task of giving away the bailout package to Greece has become more complicated with some rich nations like Germany not willing to offer much aid to Greece. The Greek premier Papandreou made his cabinet reshuffle last month to size out a rebellion started by his Socialist Party. The violent protest across the nation was against the decision of the authorities to approve a 78 billion euro package that includes increase of taxes and selling of assets.

Greece Finance Minister Evangelos Venizelos said that the decision of his European counterparts will definitely help to increase the international credibility of their country. Now the world will see how much faster the Government authorities can implement the austerity plans approved by the Parliament.

The International Monetary Fund is also fast making preparations for approval of the 3.3 billion, which they are supposed to pay as the last installment. Victory of Papandreou in the Greek Parliament has definitely improved the confidence of the investors on that country.

Greek bonds also started showing encouraging results after they rebounded during the last week. Euro and the stocks rose very high in the money and stock market. For the second consecutive week, Greek bonds were seen to be improving. The 10 year securities of Italy was gaining for the first week and the Spanish 10 years bonds declined the most in five months.

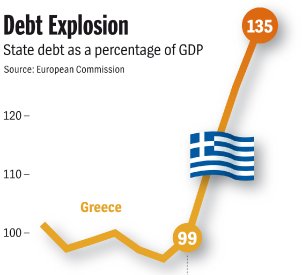

The rise of euro was 2.4% against dollar and the gain of euro was first time in the past four weeks. The debt crisis in Europe about a year ago has really threatened the strength of the 12 year old monetary union. So, to regain the strength of their currency and the different bonds, the Finance Ministers of European nations decided to bail out Greece after Ireland and Portugal. Had these nations been deprived of the bailout package, there would have been a collapse of economies across Europe and that would have really made China quite happy.

At the same time, consultations are going on with the creditors of Greece about how the yearly financing needs of the country can be decreased without avoiding any other default. Some of the options are rolling over 90% of their debt into new five year bonds with no guarantee. The accepted proposal must serve all the interests of all the financial institutions who are involved in the Greek support plan.