When recession put its grips on different world economies in 2008, Ireland was perhaps one of the few nations which went almost on the verge of bankruptcy. Today different European nations have asked Ireland to accept a bailout package from different European nations.

But Ireland government authorities are not agreeing to the proposal and they have cited various reasons for that. First of all, the government authorities feel that Ireland will be able to come out of this fiscal problem on their own, though it will take some time. Secondly, they feel that countries offering the bailout package may interfere in many sovereign matters of Ireland as the American proverb goes – no lunch is free.

The members of European Central Bank are thinking otherwise. They are of the opinion that the panic of Ireland may spread to euro-zone countries including like Portugal and Spain. So they have requested their Irish counterparts to take a bailout package from International Monetary fund and European Union rescue fund.

The proposal was given at the meeting of the EU finance ministers which is being held in Brussels for two days. The yield on 10 year bond of Ireland went down to 8.10% and the leading stocks in Irish stock market went up expecting a bailout.

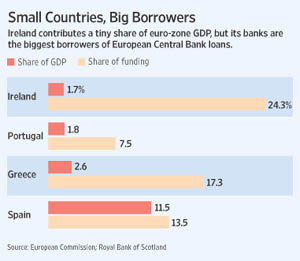

EU officials are saying that there may be a compromise solution where Ireland may be forced to accept bailout package and that money will be utilized only to recover the ailing large banks of Ireland. The borrowing costs of Ireland have gone up to a great extent and the cash starved banks of this country have asked for bailout package from ECB.

But Irish officials are saying that they have already pumped in tens of billions of dollars of tax payers money to stabilize their banking system and further infusion of funds will only make the inflation soar.